In the margins of the 143rd/144th Sessions of the WCO Council, held from 27 to 29 June 2024, the Secretary General of the World Customs Organization (WCO), Mr. Ian Saunders, and the Chairman of the State Customs Committee of the Republic of Azerbaijan, Mr. Shahin Baghirov, signed a Grant Agreement to establish the Azerbaijan Customs Cooperation Fund (CCF Azerbaijan). This fund aims to bolster Customs cooperation and capacity building along the Trans-Caspian International Transport Route, also known as the Middle Corridor.

In recent years, the WCO has received numerous requests from countries in the sub-region to provide capacity-building support to enhance Customs connectivity along the Middle Corridor. These requests highlight the corridor’s importance as a critical trade route and the need for robust Customs procedures to facilitate efficient and secure trade flows. The establishment of CCF Azerbaijan will address these demands and the challenges faced by Customs administrations due to the globalization of trade.

CCF Azerbaijan will support a range of activities, including the training of Customs officials, and the organization of seminars, workshops and meetings for the beneficiary Customs administrations. These activities are designed to promote trade facilitation, improve compliance and enforcement, enhance Customs modernization, and build the competencies and capacities of Customs officials.

This initiative aligns with the WCO’s strategic vision of fostering regional cooperation. By enhancing the connectivity along the Middle Corridor, CCF Azerbaijan aims to create a seamless and efficient trade network that boosts economic activities, strengthens regional ties, and fosters sustainable development.

The WCO welcomes this initiative, which underscores the ongoing cooperation with Azerbaijan Customs, and looks forward to further supporting Members through the new CCF Azerbaijan.

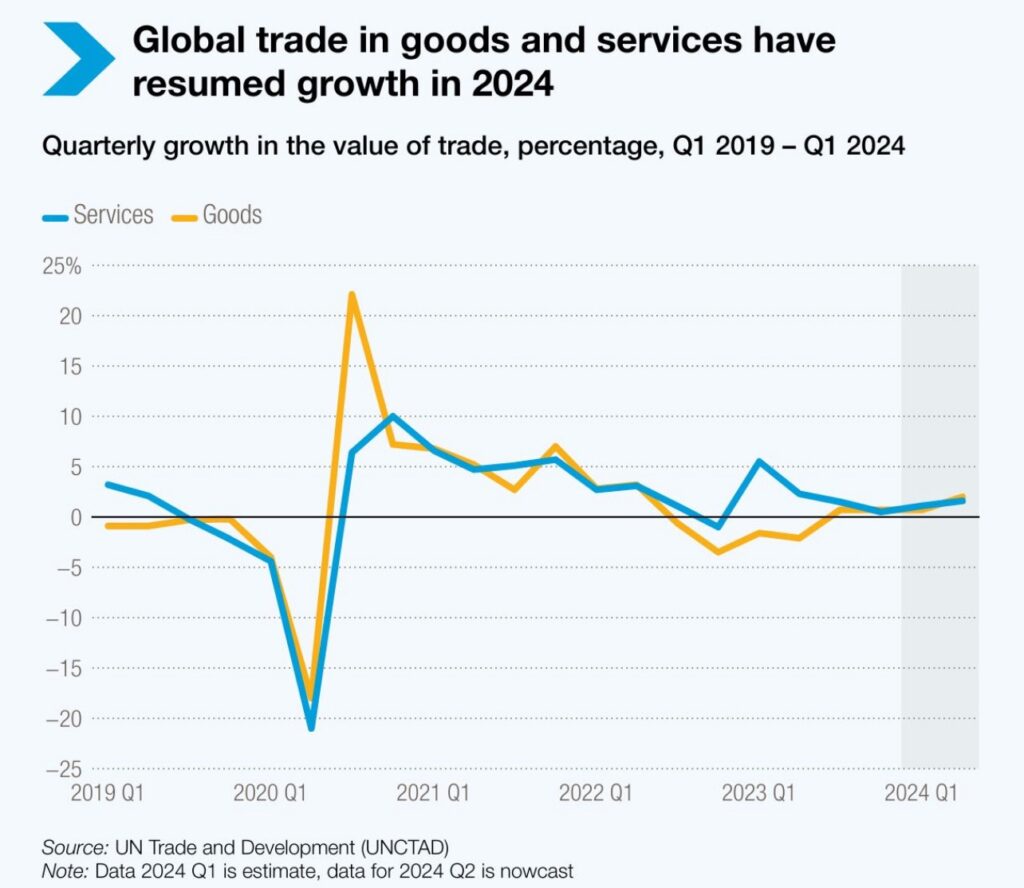

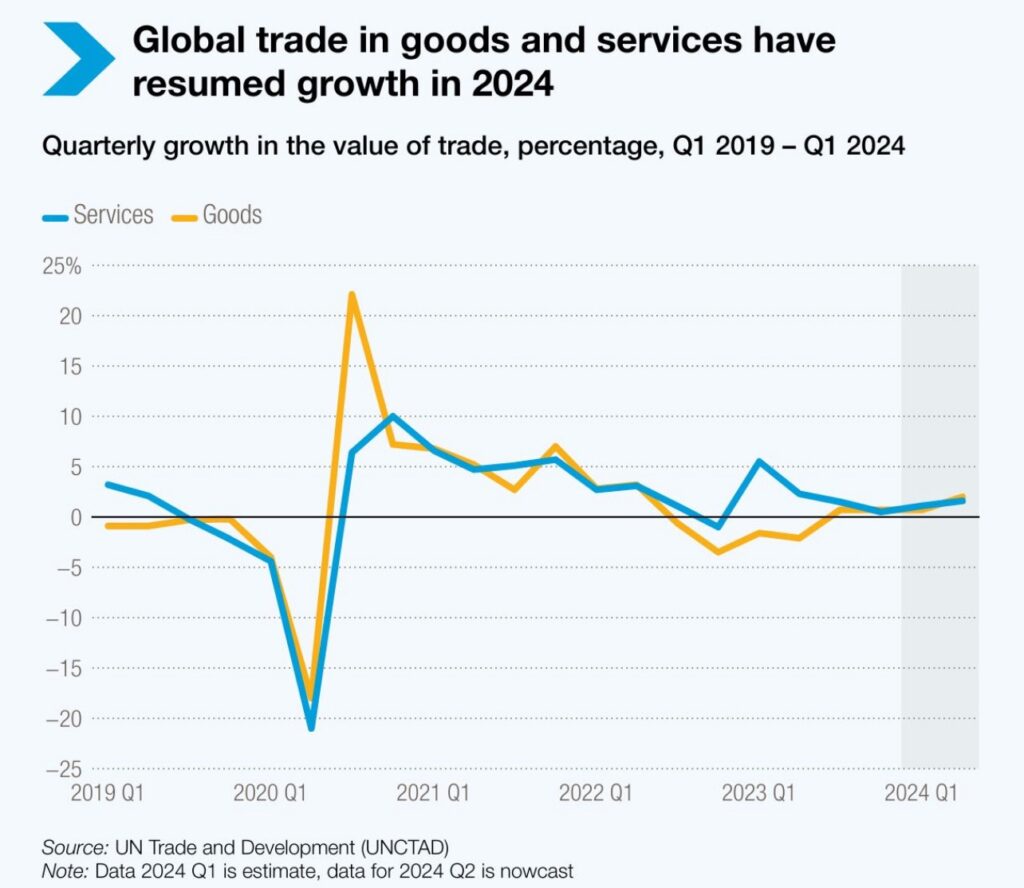

Global trade trends turned positive in the first quarter of 2024, according to the latest Global Trade Update from UN Trade and Development, launched today.

The value of trade in goods increased by around 1% quarter-over-quarter, while trade in services by about 1.5%.

This surge, fueled by positive trade dynamics for the United States and developing countries, particularly large Asian developing economies, is expected to add approximately $250 billion to goods trade and $100 billion to services trade in the first half of 2024 compared to the second half of 2023.

Global GDP growth forecasts remain at around 3% for 2024, with the short-term trade outlook being cautiously optimistic. If positive trends persist, global trade in 2024 could reach almost $32 trillion, though it is unlikely to surpass the record levels seen in 2022.

Explore the data & analysis: https://ow.ly/b4Wf50StwZo

Source:UNCTAD

Global trade trends turned positive in the first quarter of 2024, according to the latest Global Trade Update from UN Trade and Development, launched today.

The value of trade in goods increased by around 1% quarter-over-quarter, while trade in services by about 1.5%.

This surge, fueled by positive trade dynamics for the United States and developing countries, particularly large Asian developing economies, is expected to add approximately $250 billion to goods trade and $100 billion to services trade in the first half of 2024 compared to the second half of 2023.

Global GDP growth forecasts remain at around 3% for 2024, with the short-term trade outlook being cautiously optimistic. If positive trends persist, global trade in 2024 could reach almost $32 trillion, though it is unlikely to surpass the record levels seen in 2022.

Explore the data & analysis: https://ow.ly/b4Wf50StwZo

Source:UNCTAD

You must be logged in to post a comment.