What is triple-A, and which countries make the grade? Sweden is one of them.

Among the headlines in the days that followed the United Kingdom’s vote to leave the European Union, one was the fact that the country had lost its triple-Acredit rating. So what is a credit rating, and why does it matter?

In simple terms, a credit rating is the measure of how well an entity – whether that’s a country, company or individual – can pay back the money it has borrowed. In other words, its credit-worthiness. In the case of the UK, it’s a sovereign credit rating, meaning that it applies to the country as a whole. The sovereign rating is not just a measure of whether a country is good for the money, but of how it is faring politically, economically and financially.

All three of these factors have been affected by the Brexit vote, said the rating agency S&P after its decision to downgrade the UK’s sovereign credit rating.

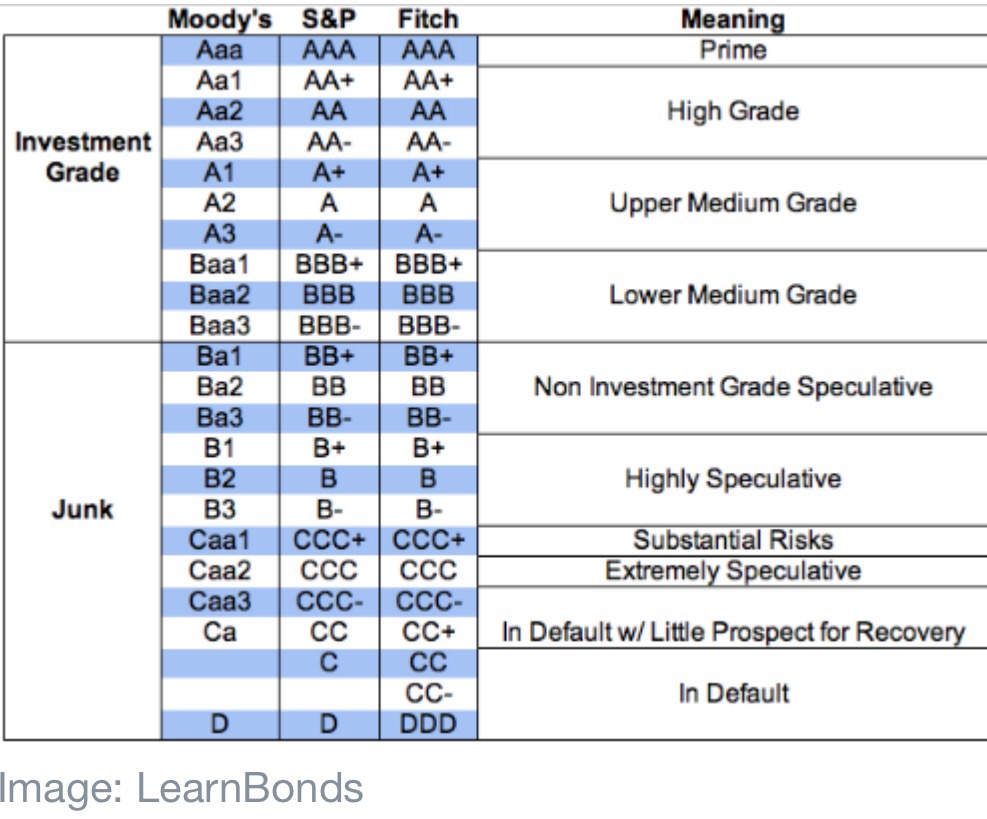

Triple-A is the highest rating that can be given, and triple-D is the lowest. Anything below a B, however, is viewed as pretty risky. The ratings are broadly divided between “investment grade” and “junk”. The lower the rating, the greater the risk that the borrower will not be able to pay back the money.

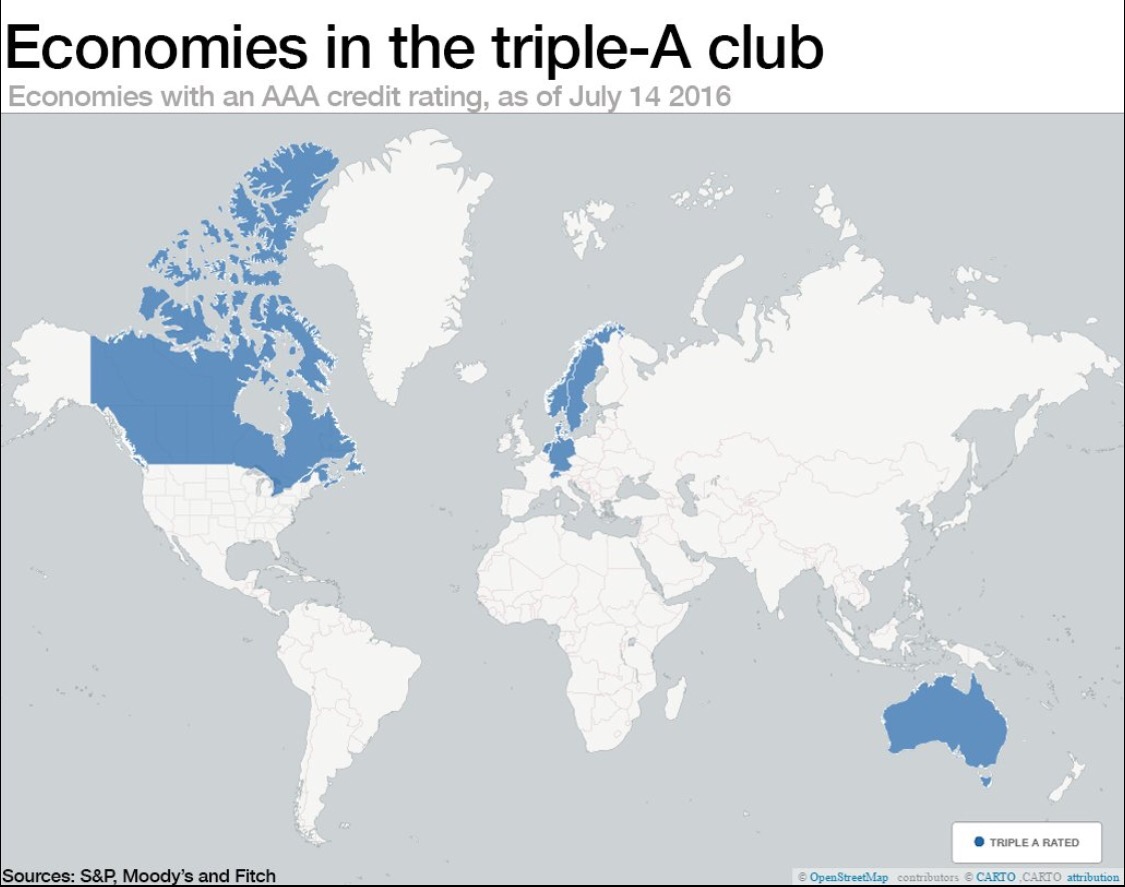

There are very few countries that belong to the AAA club. At the moment they are Australia, Canada, Denmark, Germany, Hong Kong, Liechtenstein, Luxembourg, Netherlands, Norway, Singapore, Sweden and Switzerland; and, until very recently, the UK. Hong Kong, which has Special Administrative Region status, has its own credit rating (AAA, from S&P).

You must be logged in to post a comment.