Today the mist prestious award in the world, the Nobel Prize for 2017 was awarded in Stockholm. The peace prize was awarded in Oslo as the tradition says.

On November 27, 1895, Alfred Nobel signed his third and last will at the Swedish-Norwegian Club in Paris. When it was opened and read after his death, the will caused a lot of controversy both in Sweden and internationally, as Nobel had left much of his wealth for the establishment of a prize. His family opposed the establishment of the Nobel Prize, and the prize awarders he named refused to do what he had requested in his will. It was five years before the first Nobel Prize could be awarded in 1901.

The Nobel Prozes are prizes awarded annually by the Rpyal Swedish Academy of Sceinces, the Swedish Academy, the Karoniska Ibstitutet and the Norwegian Nobel Committee.

The prizes are awarded to individuals and organizations who make outstanding contributions in the fields of chemistry, physics, litterature, peace and physiology or medicine. They were established by the 1895 will of Alfred Nobel.

The Nobel Memorial Prize in Economic Sciences was established in 1968 by the Swedish National Bank.

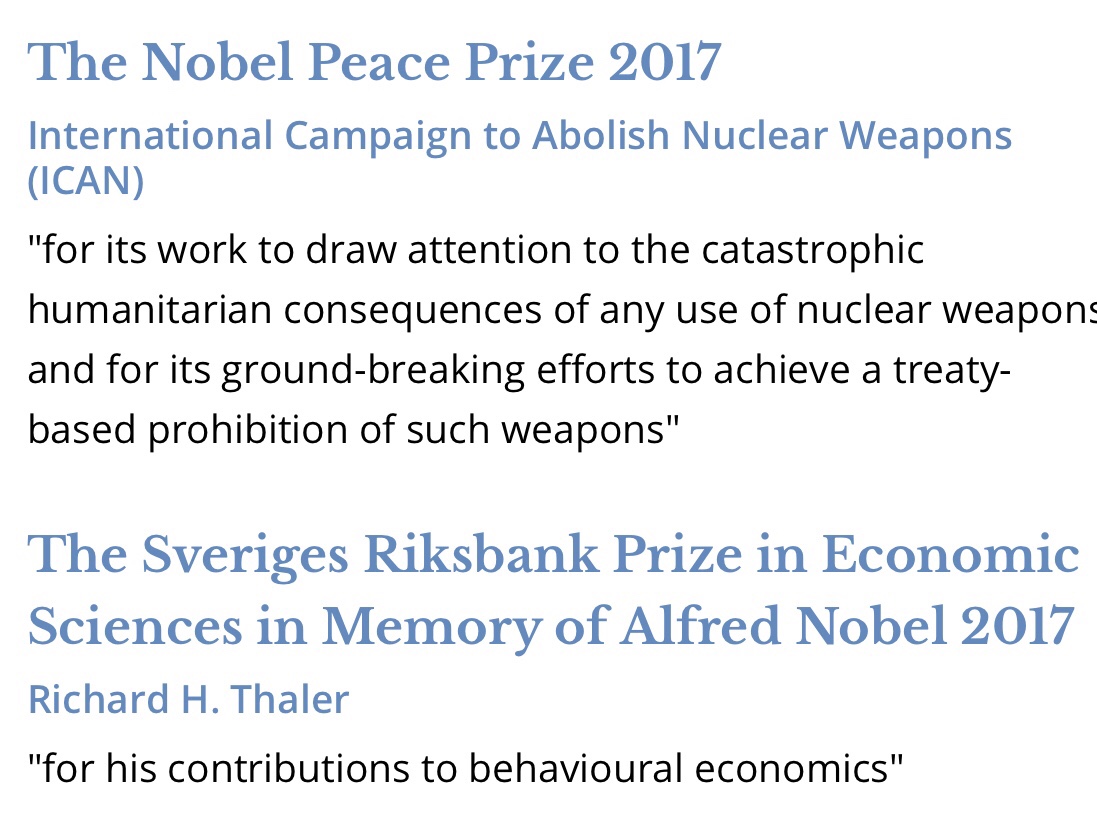

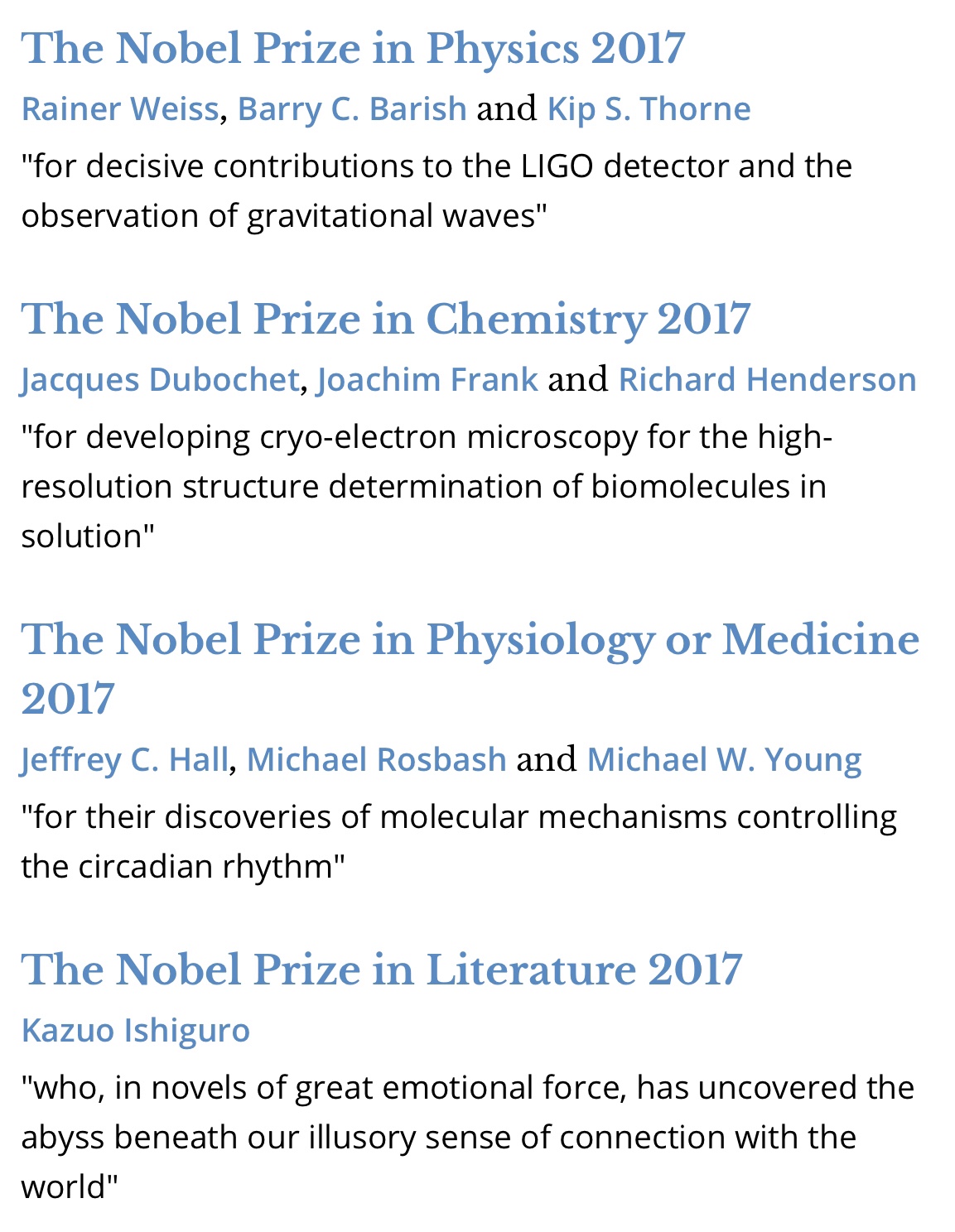

These are the 2017 Nobel Prize winners:

“I feel relieved. On Monday, it looked very critical and it was because Theresa May had not anchored the border issue at DUP. Then it looked like it was very close to bursting, but now we also have an agreedäment on the very complicated Ireland situation”, says Ann Linde Swedish Minister for EU Affairs and Trade

Next week Heads of State and Government of the EU will meet to decide on today’s agreement. Ann Linde believes it will be supported.

Then two parallel processes follow. One should negotiate how Britain’s relationship with the EU will look the first two years after its retirement on March 29, 2019, when the British want to see a transitional arrangement.

But at the same time you will also have to solve the issue on how the British relationship with the Union will look when left completely.

“We should remember that, as we are so happy today, three questions were the prerequisite for being able to negotiate. It is about a very large trade agreement, the largest ever negotiated by the EU, which adds cooperation on terrorism, climate, foreign policy and such matters. It will be an unremitting effort to get such an agreement”.

Ann Linde believes that the agreement is of great importance to Swedish citizens.

“Sweden has huge trade relations with the UK and a large part of our exports go there. If we do not get good rules, it affects companies but also growth and jobs in Sweden. It is especially important for the 100,000 Swedes living in Britain”. There is still some way to go, but tonight we celebrate.

I have been involved in the BREXIT dialogue and with BREXIT advisory work for more than one year already. Still we have just started.

Last week I presented my academic report on BREXIT Northern Ireland-Ireland border, ‘SmartBorder 2.0’ to the European Parliment in Brussel. It was the EP Consitutional Committee that had commissioned the report.

I have had very positive feedback on the report both on UK and EU sides. Also media has picked up the proposal. I have been quoted in more than 15 papers and interviewed in several TV channels, including BBC.

Read ‘Flip Chart Fairy Tales’, an interesting blog about this type of topic.

The blog owner and author, who also writes for Finanacial Times, has written an article about the Northern Ireland-Irland border, referring to my report and quoting my twitter account:

It is a good article, but also this article though make the mistake of referring to how exisiting operational border solutions could be used at the EU-UK borders comparing these models with the potential situation at the new UK border. This simply does not work.

The Sweden-Norway border and the Switzerland-France border solutions are among the best in the world but they were designed and developed for another environment in another time.

My argument is that these borders, and some other operational best practice examples like e.g. United States-Canada border, have all the necessary components of a Smart Border solution. However, the model for UK-EU must be upgraded and considerably further developed – as well as adjusted – to the specific UK-EU environment. This is obvious. So saying that these solutions would bot work for e.g. The Ireland-Northern Ireland border is true and wrong. In the way they look now: no. In the way they could be implemented: yes.

Same thing happens when I mention the need of a new AEO, Authorized Economic Operator programme. People directly think about the EU AEO programme and the way that programme is designed and operated today.

First of all, there are a number of AEO programmes that are more modern than the EU AEO concept, as well as e.g. the U.S. C T-PAT programme.

These legacy programmes were contructed ten years ago for another world. They are old solutions and not state-of-the-art anymore.

Today there are modern, holistic, operational compliance management – AEO and Trusted Traders programmes – like; AEO Brazil, Australian Trusted Trader, UAEO.

These programmes are very different models than the EU AEO model and have extensive benefit programmes, system support, AEO KPI/performance measurement systems, effecient joint monitoring tools etc etc – while still meeting the international standards.

This is what I am talking about as the highest tier in a new UK Trusted Trader programme.

Such a programme will also have several lower tiers for different types of operators, like the legendary Swedish Stairway Concept. Still considered the most effcient model ever.

The lower tiers will be easier to access for SMEs and other operators, that only need to be known, having a acceptable level of compliance based on risk. The different tiers will have different benefit programmes as well.

The two examples mentioned in this blogpost are excellent illustrations why some people fully understandably don’t get the correct picture of what we are talking about.

We make references to international standards and use exisiting terminology as examples, when we really are talking about something else – meaning more advanced versions of these best practices. So terminology gets in the way of the real debate.

In the future, let’s talk and compare apples with apples and pears with pears. I will do my best to contribute to that debate.

You must be logged in to post a comment.