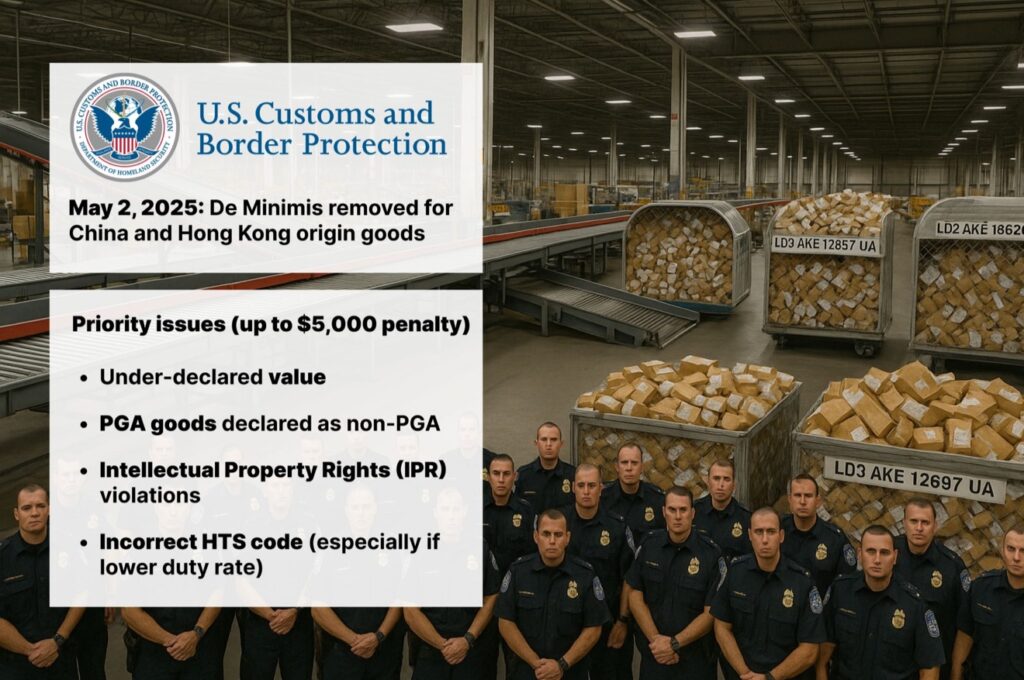

Enforcement is coming

Hugo Pakula is weoting that CBP has begun saying that $5,000 penalties are going to be handed out for these issues starting today.

With Section 321 being suspended for China- and Hong Kong-origin goods, Customs knows that the status quo is changing. They know how importers will try and circumvent their targeting and penalties

Those that are circumventing or mitigating tariffs by under-declaring the value of goods (like using cost price without a formal first sale program in place) are priority number 1 — stealing revenue from the US government is not looked upon fondly.

Next are other key issues caused by poor data quality during this transition from the de minimis treatment (duty-free, simple clearance) that importers have gotten used to:

- PGA goods (like cosmetics, food+drink, pharmaceuticals, wooden and paper articles, and more) being filed without proper PGA filings and documentation

- Items with IP markings but without a licensing agreement or proof of IP ownership

- Incorrect HTS codes, whether due to poor product descriptions, or intentionally classified incorrectly to reduce duty rates

These issues were hard to uncover in a duty-free environment. Now things are changing.

If you do not have:

- Adequate product descriptions (what is it, what is it made of, and what is the intended use)

- Confidence in your HTS classifications (AI classification may not suffice, if your descriptions were not up to par)

- Quality and accessible master data

- A compliance system with automated processes and reporting to help get you audit-ready

- A sufficient bond to cover your newly-dutiable imports

You need to prepare right now and speak to a customs expert who can help you navigate this.

It has never been more important than today to know your customs strategy.

It has never been more important than today to have quality master product data, and to have a close relationship with your customs broker.

You must be logged in to post a comment.