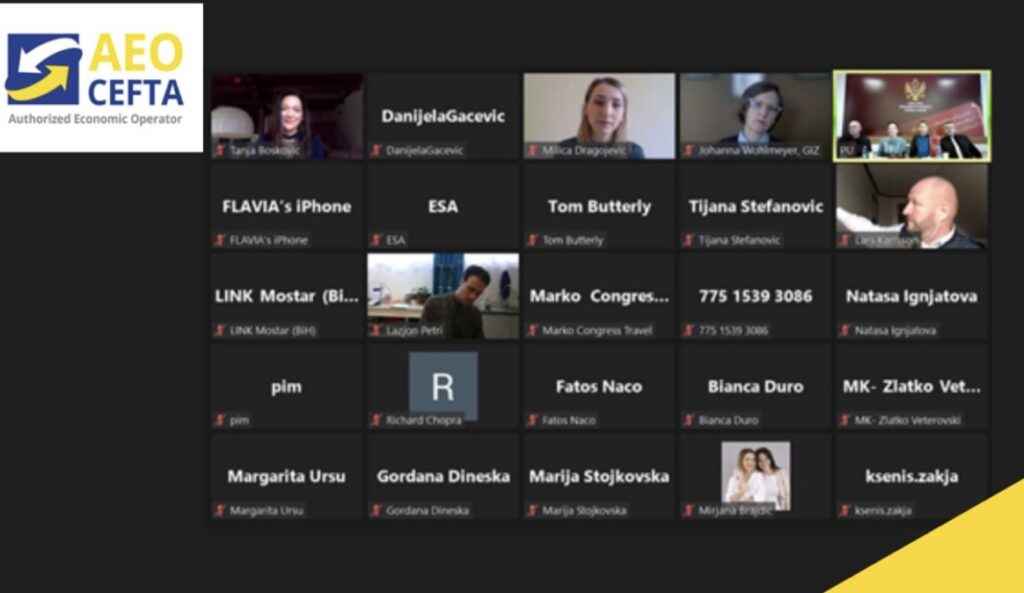

Today I participated with a Key Note Speech on AEO and the Future of Trusted Traders at the landmark launch of the new CEFTA AEO Association with AEO companies & customs administrations from the CEFTA region.

Thank you to GIZ, European Commission & the CEFTA secretariat – as well as CEFTA Governments & private sector, for inviting me & for making this great progress possible.

I am looking forward to supporting the continued development of AEO in CEFTA & the world.

As a trader involved in UK tarde a number of things are changing atvthe end of the year.

HMRC have reminded traders to prepare for customs changes that come into effect on 1 January 2022.

1. Customs declarations

Traders will no longer be able to delay making import customs declarations under the Staged Customs Controls rules that have applied during 2021. Most customers will have to make declarations and pay relevant tariffs at the point of import.

Traders need to consider before 1 January 2022 how to submit customs declarations and pay any duties that are due. A trader can appoint an intermediary, such as a customs agent, to deal with the declarations on the traders behalf or submit customs declarations directly.

2. Border controls

Ports and other border locations will be required to control goods moving Great Britain and the EU. This means that unless goods have a valid declaration and have received customs clearance, they will not be able to be released into circulation, and in most cases will not be able to leave the port.

From 1 January 2022, goods may be directed to an Inland Border Facility for documentary or physical checks if these checks cannot be done at the border.

It’s important that those involved in transporting goods are ready and understand how traders intend to operate from January 2022.

From 1 January 2022, traders must also submit an “arrived” export declaration if the goods are moving through one of the border locations that uses the arrived exports process.

If traders do not follow the correct process from 1 January 2022, the new systems will not permit the goods to leave the country and they will be turned away as they will not hold export clearance.

If traders use a service such as a courier or freight forwarder to move your goods, there is a need to check their terms and conditions about who will make the declarations, and what other information they need from the trader to do this.

3. Rules of origin – for imports and exports

The UK’s deal with the EU, called the Trade and Cooperation Agreement (TCA), means that the goods you import or export may benefit from a reduced rate of Customs Duty (tariff preference). To use this, traderd need proof that the goods:

- imported from the EU originate there

- exportd to the EU originate in the UK

By ‘originate’ means where goods (or the materials, parts or ingredients used to make them) have been produced or manufactured. It is not where the goods have been shipped or bought from. The goods will need to meet the product specific rules of origin requirements set out in the TCA.

UK and EU importers can claim tariff preference if they have one of the following proofs of origin:

- a statement on origin – this must be made out by the exporter to confirm that the product originates in the UK or EU

- the importer’s knowledge – this option allows the importer to claim tariff preference based on their own knowledge of where the goods they’re importing originate from

If traders export goods to the EU and provide the EU importer with a statement on origin, but may also need to have a supplier declaration in place. These are needed to confirm the origin of the goods exported when the manufacture alone is not enough to meet the product specific rules of origin.

Throughout 2021, traders have been allowed to export goods to the EU using tariff preference and get supplier declarations afterwards, to give trders more time. But from 1 January 2022 traders must have supplier declarations (where required) at the time the goods is exported

If the trader cannot provide a supplier declaration to confirm the UK origin of goods exported to the EU between 1 January and 31 December 2021, there is an obligation to let customers know.

If a trader is subject to a request for verification by EU customs authorities and the trader can’t provide this supporting evidence, the EU customer will be liable to pay the full (non-preferential) rate of Customs Duty and UK authorities may also charge a penalty.

4. Commodity codes

Commodity codes are used worldwide to classify goods that are imported and exported. They are standardised to 6-digits and reviewed by the World Customs Organisation every 5 years. Following the end of the latest review, the UK codes will be changing on 1 January 2022

5. Further changes from 1 July 2022

Further changes will be introduced from July 2022, which we’ll let you know more about nearer the time.

These will include:

- requirements for full safety and security declarations for all imports

- new requirements for Export Health Certificates

- requirements for Phytosanitary Certificates

- physical checks on sanitary and phytosanitary goods at Border Control Posts

Source: UK Government

The UAE will switch its weekend to Saturday and Sunday for government entities as it looks to bring itself more in line with the rest of the world.

The Gulf nation, of which Abu Dhabi and Dubai are wonof the Emirates, will adopt a 4-1/2 day working week with Friday — a holy day in Islam — becoming a half day.

You must be logged in to post a comment.